how does an open end loan work

Banks and credit unions may offer open-end credit to. What Is an Open-End Loan and How Does It Work.

What Is Open End Credit How It Works Examples Pros And Cons Cash 1 Blog News

An open end mortgage is a type of home loan that allows borrowers to access funds as they need them.

. This can simplify paperwork because a. How does an Open-End Mortgage work. An open-end mortgage is a type of mortgage that allows the borrower to increase the amount of the mortgage principal outstanding at a later time.

Open-end mortgages are distinct. What Is an Open-End Loan and How Does It Work. One of the reasons why an open-end credit is preferred is that it makes money available to borrowers if and when it is.

Disadvantages of Open-End Credit Products. If approved you will be able to borrow additional funds on the same loan amount. An open-end loan is a preapproved loan between a financial institution and a borrower that can be used repeatedly up to a certain limit and then paid back before.

With an open-end mortgage youll still be approved to take out the entire 400000 but youll only pay interest on the money you actually end up using. An open-end mortgage allows you to access your home equity and use the funds as necessary. An end loan might be part of a combination of construction or end loan which allows a borrower to deal with just one lender.

How does an open end loan work. Leave a Reply Cancel reply. Simply put an open-end mortgage allows you to tap into your home equity which means you can use the funds you get for whatever purpose.

How Do Open Loans Work. While closed-end loans limit the amount of money you can borrow over the life of the loan open-end loans give you more flexibility. Unsecured open-end credit lines generally have higher interest rates.

Open-end credit works by giving account holders a revolving credit account to finance transactions or draw funds. Skip primary navigation links. Open-end credit is a pre-approved loan granted by a financial institution to a borrower that can be used repeatedly.

Advantages of Open Credit. With open-end loans like. An open-end mortgage is a type of mortgage that allows the borrower to increase the amount of the mortgage principal outstanding at a later time.

An open-end mortgage allows you to tap into the equity in your home and use the funds as necessary. Read this article to learn the ins and outs of this loan. Once the lender approves your.

This differs from traditional loans that require borrowers to pay back the total amount at. Open-end lines of credit and loans do have their drawbacks. An open-end loan is a preapproved loan between a financial institution and a borrower that can be utilized repeatedly up to a specific limit and then paid back before.

How an Open-End Mortgage Works An open-end mortgage works like a hybrid between a traditional mortgage and a HELOC except you only have to apply once instead of. A delayed draw term loan is comparable to an open-end mortgage. Enter your name or username to.

It also contains revolving credit-like qualities.

Upgrade Personal Loans Cards And Rewards Checking

What Is An Open End Mortgage Supermoney

Lines Of Credit Types How They Work How To Get Them

The Top 9 Reasons To Get A Personal Loan Bankrate

Difference Between Open End Credit And Closed End Credit

/GettyImages-1173647137-de07577da0184ccca8aef4d0a99e1768.jpg)

Understanding Closed End Credit Vs An Open Line Of Credit

Opsc On Twitter Doyouknow Sofi At Work Has Partnered W The Aoafordos And Opsc For The 50k Healthcare Heroes Sweepstakes Visit Https T Co I5bgmhqvmp Click The Put A Dent In Your Student Loan Link

Please Edit The Code To Make It Work For The First Chegg Com

Sofi Invest Review Pros And Cons Costs Who Should Open An Account

Open End Mortgage Loan What Is It And How It Works

Paying Off Personal Loans Early Pros Cons Lendingclub

Open End Mortgage Loan What Is It And How It Works

How To Finance A Car And Get A Car Loan U S News

Difference Between Open End Credit And Closed End Credit

Credit And Loans Federal Trade Commission

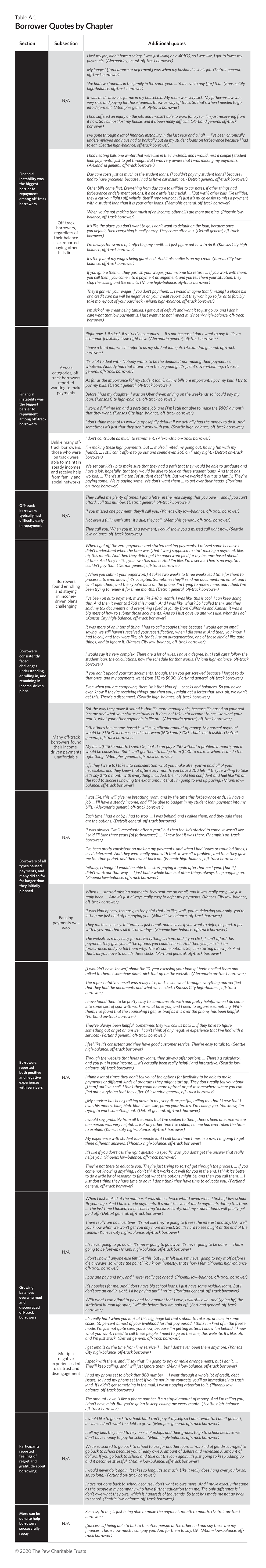

Borrowers Discuss The Challenges Of Student Loan Repayment The Pew Charitable Trusts